hawaii capital gains tax on real estate

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. 100 shares of Z Co b.

We Buy Houses Fast We Buy Houses Sell House Fast Hawaii Real Estate

Power of Attorney Beginning July 1 2017 the Department will require any person who represents a taxpayer in a professional capacity to register as a verified practitioner Any person who is not required to.

. Increases the capital gains tax threshold from 725 per cent to 9 per cent. PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly below Hawaiis.

808-866-6593 Ben Harper RS 80314. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. There are two types of capital gains tax.

In Hawaii real estate generates 7 percent capital gains tax. The difference between how much is withheld and how much is owed is the amount of your refund. Each states tax code is a.

Here is a look at what the brackets and tax rates are for 2021 filing 2022. Hypothetically a married couple purchases an investment property with a Section 1031 exchange. As a real estate investor you may defer capital gains tax and recapture tax by selling one or more investment properties and purchase one or more like kind investment properties at equal or greater value.

Earned Income Tax Credit. How does hawaii rank. You are subject to Hawaii capital gains tax of up to 725 on the profit gain realized on the transaction.

At the end of six years they decide to sell netting a total gain of 900000. 2016REV 2016 To be filed with Form N-35 Name Federal Employer ID. Hawaii State Income Tax Forms for Tax Year 2021 Jan.

This July 1 2021 through June 30 2022 fiscal year 2021 rate applies to homes. They are long-term and short-term. Here are the basic 1031 exchange rules.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. What is the actual Hawaii capital gains tax.

To calculate capital gains tax you deduct the assets original cost from the total sale price. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Like kind means both the relinquished sold and replacement bought properties need to be investment properties.

Kind of property and description Example. Hawaii Department of Taxation will want at closing 5 percent of the sale. For real-estate property tax rates we divided the median real-estate tax payment by the median home price in each state.

The rates are between 0 and 20 depending on your tax bracket. Effective for tax years beginning after 12312020. 2022s Tax Burden by State.

They rent the home for three years and then convert the home to their principal residence. When you live out of state and you sell property in Hawaii the transaction may be subject to tax withholding. Hawaii Elite Real Estate brokered by EXP Realty RB 21841 - 500 Ala Moana Blvd.

Hawaii taxes gain realized on the sale of real estate at 725. Real Estate Tax Rate. The state of Hawaii will keep your money if you do not submit the appropriate refund requests.

You can defer paying capital gains tax on the sale of an investment or business property if you use the proceeds of the sale to purchase a similar property replacing the one you sold. Any property dispositions on or after the 15th of September that do not qualify for an exemption will now be subject to a 75 withholding rate. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate. Under normal circumstances section 121 allows them to exclude 500000. Suite 400 Contact an Agent.

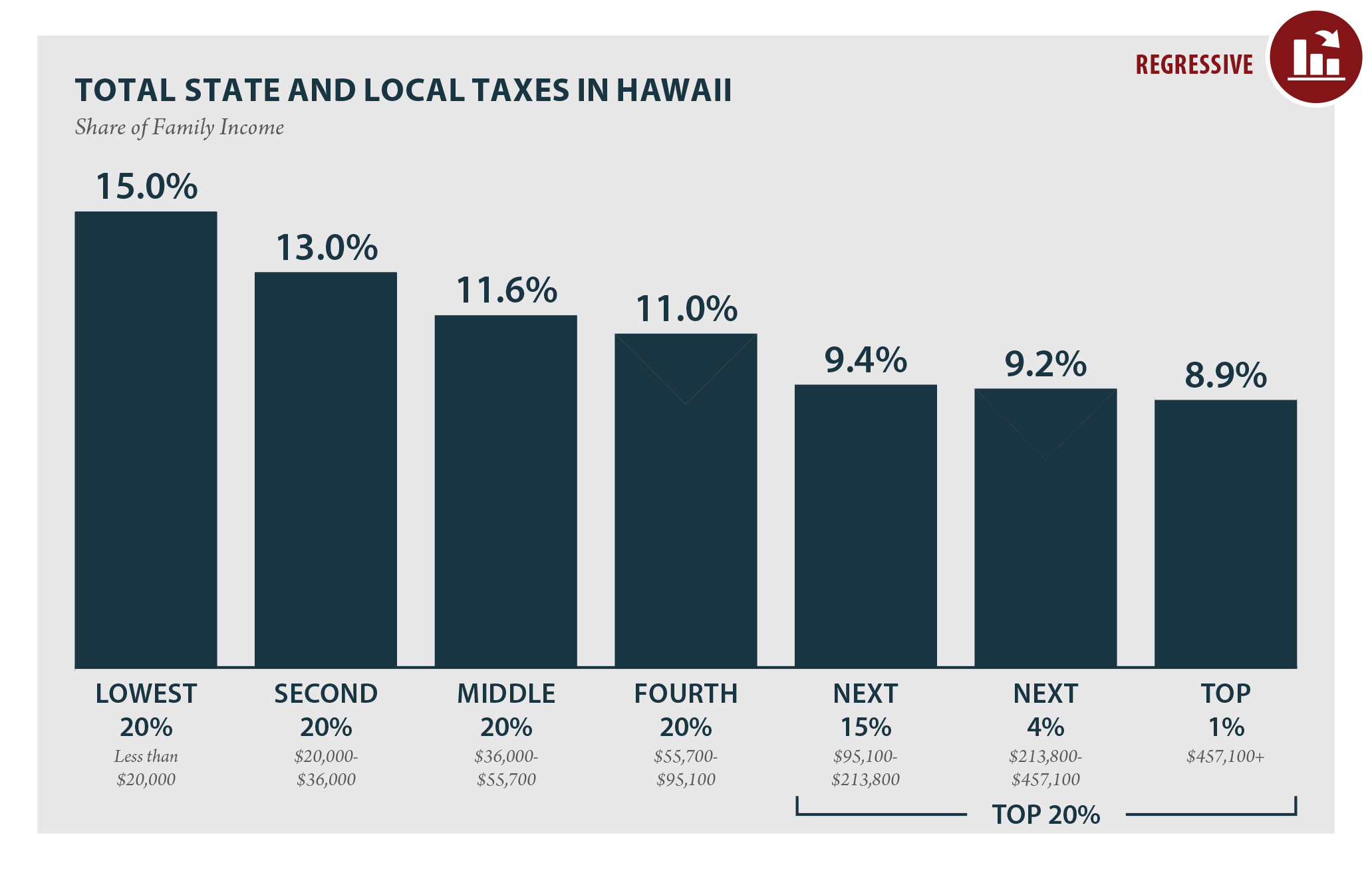

7 rows Certification for Exemption from the Withholding Tax on the Disposition of Hawaii Real Property Interests. Hawaii capital gains tax 2022. Hawaiʻi is one of only nine states that taxes all capital gainsprofits from the sale of stocks bonds investment real estate art and antiquesat a lower rate than ordinary income.

The Hawaii capital gains tax on real estate is 725. The Hawaii capital gains tax on real estate is 725. This applies to all four factors of gain refer below for a discussion of the four factors.

Hawaii General Excise Tax GET of 400-450 is due on all long term rental of over 180 days. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains. You pay long-term capital gains tax on assets you held for longer than a year.

GET and Transient Accommodation Tax TAT of 1025-1050 is due on all short term rentals of under 180 days. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased.

Hawaii Who Pays 6th Edition Itep

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

You May Be Feeling A Little Antsy Right Now And Converting Your Garage In To A Home Gym Rec Room Or Man Ca Hawaii Real Estate Las Vegas Real Estate Rec

Buying A Condo On Maui Buying A Condo Maui Real Estate Maui

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Harpta Firpta Tax Withholdings Avoid The Pitfalls Hawaii Living Blog In 2021 Tax Refund Hawaii Real Estate Tax

Hawaii Income Tax Hi State Tax Calculator Community Tax

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Harpta Maui Real Estate Real Estate Marketing Maui

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

The Ultimate Guide To Hawaii Real Estate Taxes

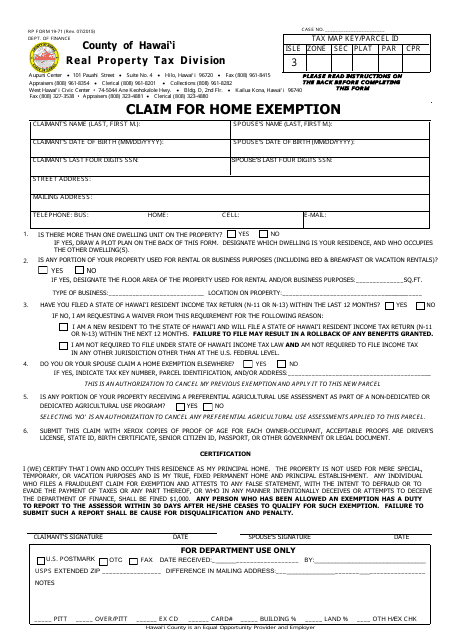

Form Rp19 71 Download Fillable Pdf Or Fill Online Claim For Home Exemption County Of Hawai I Hawaii Templateroller

Condos For Sale In Lahaina Hawaii 388943 Maui Real Estate Hawaii Real Estate Condos For Sale

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

Harpta Explained Harpta Refund Solutions

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram